Welcome, fellow adventurer! At Vietnam Adventure, we understand that sometimes, the most profound journeys are those of connection and support, even across vast oceans. If you’re wondering how to send money from us to vietnam, rest assured it’s easier than you might think. The most straightforward and widely used methods to send money from the US to Vietnam involve online money transfer services, bank wire transfers, and specialist remittance companies. Each offers varying speeds, fees, and exchange rates, so choosing the best one depends on your specific needs and urgency. This guide will illuminate your path, ensuring your financial support reaches your loved ones in Vietnam with ease and confidence.

Navigating the World of International Money Transfers

Sending money internationally can feel like stepping into a labyrinth, but with a few guiding principles, you’ll find your way. We’re here to demystify the process for you. Whether it’s for family support, a special gift, or helping a friend, understanding the options for how to send money from us to vietnam is key.

Online Money Transfer Services: A Digital Bridge

In our modern, interconnected world, online platforms have become a favorite for many looking to how to send money from usa to vietnam. These services typically offer competitive exchange rates and lower fees compared to traditional banks, making them an attractive option. They are generally fast, often delivering funds within minutes or a few hours, depending on the service and the payout method.

- Speed: Often instantaneous or within a few hours.

- Fees: Generally lower than traditional banks.

- Exchange Rates: Can be very competitive.

- Convenience: Send money from your computer or smartphone anytime, anywhere.

- Examples: Remitly, Wise (formerly TransferWise), Xoom (a PayPal service), WorldRemit, Instarem. Each has its own strengths, so it’s wise to compare their rates and fees for your specific transfer amount.

Traditional Bank Wire Transfers: A Classic Choice

For those who prefer a more traditional route, bank wire transfers are a reliable method to how to send money to vietnam. While often perceived as more secure, they can sometimes involve higher fees and slower processing times compared to online services. You’ll typically need your recipient’s bank name, account number, and SWIFT/BIC code. Remember to factor in potential intermediary bank fees that might reduce the final amount received.

- Security: High level of security through established financial institutions.

- Processing Time: Typically 1-5 business days.

- Fees: Can be higher, sometimes with additional intermediary bank charges.

- Requirements: Recipient’s bank details, including SWIFT/BIC code.

Specialist Remittance Companies: Tailored for Expats and Travelers

Many communities thrive on dedicated remittance services that cater specifically to sending money to particular regions, including Vietnam. These often combine the reliability of traditional methods with the efficiency of modern platforms. Services like Western Union and MoneyGram fall into this category, offering cash pickup options which can be vital for recipients who may not have bank accounts.

- Accessibility: Wide network of agent locations for cash pickup.

- Speed: Cash can be available for pickup within minutes.

- Fees and Exchange Rates: Varies significantly; always compare.

- Recipient Options: Cash pickup, bank deposit, or even mobile wallet deposits.

What You’ll Need to Send Money

Regardless of your chosen method to how to transfer money to vietnam, having the right information ready will make the process smooth and stress-free. It’s like preparing for a beautiful journey, knowing all your essentials are packed.

- Recipient’s Full Name: As it appears on their official identification.

- Recipient’s Address: A current residential address in Vietnam.

- Bank Name and Account Number (for bank transfers): Ensure these are accurate to avoid delays.

- SWIFT/BIC Code (for international bank transfers): This unique code identifies the recipient’s bank.

- Recipient’s Phone Number: Essential for notifications and contacting them if needed.

- Your Identification: A valid government-issued ID (driver’s license, passport).

- Payment Method: Your bank account details, debit card, or credit card.

Choosing the Best Path for Your Transfer

With several options available, deciding on the “best” way to send money depends on what matters most to you and your recipient. Consider these aspects:

Cost and Exchange Rates

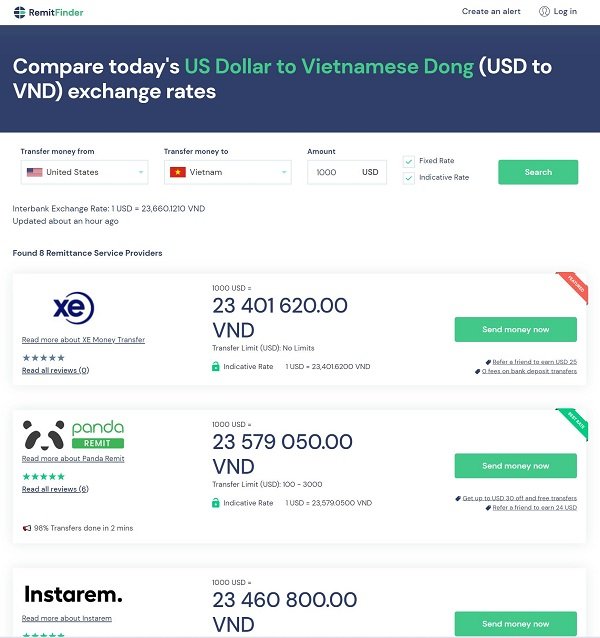

Fees and exchange rates can significantly impact the final amount received. Always compare multiple services. Some services might offer lower fees but a less favorable exchange rate, or vice versa. Look for transparency in their pricing.

Speed of Transfer

Is the money needed urgently? Online services often boast instant transfers, while bank wires can take several business days. Plan accordingly based on your recipient’s needs.

Convenience for Both Sender and Receiver

How easy is it for you to send, and for your recipient to receive? Consider factors like online accessibility for you and proximity to cash pickup locations or ease of bank deposit for them.

Security and Reliability

Always use reputable services. Look for platforms that are regulated and have strong security measures to protect your money and personal information. Reviews and ratings from other users can be a helpful indicator.

Navigating Vietnamese Banking and Receiving Options

Understanding the local landscape in Vietnam can further streamline your transfer process. Most major Vietnamese banks are equipped to handle international transfers.

- Direct Bank Deposits: Many online services and banks offer direct deposits to popular Vietnamese banks like Vietcombank, Techcombank, Agribank, BIDV, and Sacombank.

- Cash Pickup Locations: For services like Western Union and MoneyGram, recipients can collect cash from various agent locations across Vietnam, including post offices, specific bank branches, and dedicated remittance centers.

- Mobile Wallets: While less common for direct international transfers from the US, some services are starting to offer transfers to mobile wallets in Vietnam, which is a growing trend.

Avoiding Common Pitfalls

Even with the best intentions, a few missteps can cause delays or issues. Here are some tips:

- Double-Check Details: A single wrong digit in an account number or a misspelled name can halt a transfer. Verify all recipient information carefully.

- Understand Fees: Be aware of all fees, including sender fees, recipient fees, and any potential intermediary bank charges.

- Monitor Exchange Rates: Exchange rates fluctuate. If you’re not in a hurry, watching the rates for a better opportunity can save you money.

- Keep Records: Always keep a record of your transaction, including the reference number, for easy tracking and in case you need customer support.

Supporting Your Loved Ones on Their Journey

Sending money isn’t just a transaction; it’s an act of care and connection. Whether it’s to support family, contribute to a loved one’s education, or simply send a thoughtful gift, your efforts bridge distances. As you explore the enchanting landscapes and vibrant culture of Vietnam, remember that your financial support strengthens those bonds, allowing your loved ones to thrive and experience the richness of their own journey.

Understanding Transfer Costs to Vietnam

When considering how to send money from us to vietnam, the costs involved are a significant factor. Here’s a brief comparison of typical fee structures, though these can vary widely based on the amount, service, and current exchange rates.

| Service Type | Typical Fees (as % or fixed) | Exchange Rate Impact | Estimated Delivery Time |

|---|---|---|---|

| Online Transfer Services (e.g., Wise, Remitly) | Low fixed fees + small percentage; often transparent. | Generally competitive, close to mid-market rate. | Minutes to a few hours. |

| Traditional Bank Wire Transfers | Higher fixed fees (e.g., $25-$50), potential intermediary fees. | Often less favorable than specialist services. | 1-5 business days. |

| Cash Pickup Services (e.g., Western Union, MoneyGram) | Varying fees, can be higher for instant cash. | Can have a wider spread, impacting total received. | Minutes (for cash pickup) to 1-2 days (for bank deposit). |

Always use a service’s online calculator to see the exact fees and exchange rate for your specific transfer before committing. This ensures you have a clear picture of the total cost and the amount your recipient will receive.

Frequently Asked Questions about Sending Money to Vietnam

How quickly can I send money from the US to Vietnam?

The speed depends on the service you choose. Online money transfer services like Remitly or Wise can often deliver funds within minutes or a few hours for cash pickup or direct bank deposits. Traditional bank wire transfers usually take 1-5 business days.

What information do I need from the recipient in Vietnam?

You’ll typically need their full legal name (as it appears on their ID), their address, and their phone number. For bank deposits, you’ll also need their bank name, account number, and the SWIFT/BIC code for their bank branch.

Are there any limits on how much money I can send?

Yes, most services have daily, weekly, or monthly sending limits. These limits can vary based on the service provider, your verification level, and the specific regulations in both the US and Vietnam. Large transfers might require additional documentation.

What are the safest ways to send money to Vietnam?

Reputable online money transfer services, established banks, and well-known remittance companies like Western Union or MoneyGram are generally considered safe. Always ensure the service is licensed and regulated, and be wary of unsolicited requests for money or suspicious offers.

Can I send money directly to a mobile wallet in Vietnam?

While some international services are beginning to offer mobile wallet transfers to certain countries, direct transfers from the US to mobile wallets in Vietnam are not yet as widely available as bank deposits or cash pickups. Always check with your chosen service for the latest options.

How do exchange rates affect my transfer?

Exchange rates play a crucial role in how much money your recipient receives. A better exchange rate means more Vietnamese Dong for your US Dollar. Always compare the exchange rates offered by different providers, as they can fluctuate and impact the final amount significantly, in addition to any fees.

Conclusion: Bridging Distances with Confidence

Sending money to Vietnam doesn’t have to be a daunting task. By choosing the right service and being prepared with the necessary information, you can ensure your financial support reaches your loved ones efficiently and securely. Whether you’re a seasoned traveler or simply looking to connect with family across the globe, understanding how to send money from us to vietnam empowers you to maintain those vital connections. At Vietnam Adventure, we believe in fostering deep connections, both within Vietnam and across borders. We’re here to help you navigate every aspect of your journey, ensuring that your experience is as enriching and meaningful as possible.