As you dream of new horizons and exciting opportunities, consider the vibrant landscape of Vietnam. Here at Vietnam Adventure, we’re not just about crafting unforgettable journeys through this captivating land; we also see its incredible potential for growth and development. If you’re pondering what to invest in Vietnam, the direct and concise answer is often found in its booming sectors: real estate, manufacturing, technology, and renewable energy. Vietnam is not just a destination; it’s an emerging economic powerhouse ripe with possibilities for the discerning investor.

Unlocking Vietnam’s Economic Potential

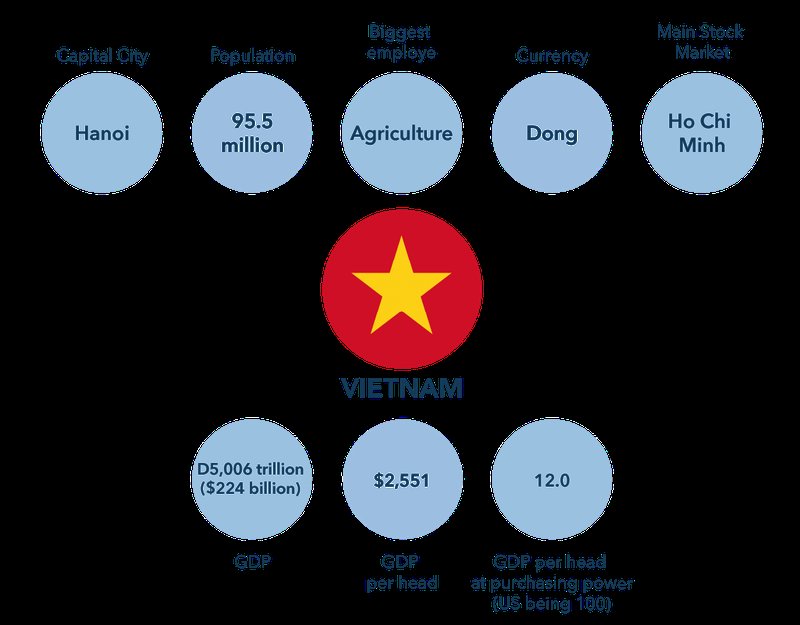

Vietnam’s economic narrative is one of remarkable resilience and rapid expansion. With a youthful, dynamic population and a government keen on attracting foreign direct investment, the country presents a compelling case for those wondering what to invest in Vietnam. The air here buzzes with entrepreneurial spirit, from the bustling markets of Hanoi to the tech hubs of Ho Chi Minh City. This vibrant energy translates into diverse investment opportunities across various sectors.

The Allure of Real Estate

Imagine the evolving skylines of Ho Chi Minh City and Hanoi, adorned with modern residential complexes, gleaming office towers, and luxurious resorts. Vietnam’s real estate market has been a consistent magnet for investors, driven by rapid urbanization, a growing middle class, and increasing tourism. Investing here isn’t just about property; it’s about becoming a part of the country’s transformation. Residential, commercial, and industrial properties all hold significant promise. The demand for quality housing, retail spaces, and industrial parks continues to climb, making real estate a cornerstone when considering what to invest in Vietnam.

Manufacturing Marvels and Supply Chain Strength

Vietnam has firmly established itself as a global manufacturing hub, a true testament to its strategic location, competitive labor costs, and robust trade agreements. From electronics to textiles, factories across the nation hum with productivity, feeding global supply chains. For those exploring what to invest in Vietnam, manufacturing offers a tangible entry point into a sector with proven growth and export potential. Many multinational corporations have already established a significant presence, benefiting from supportive government policies and an eager workforce. This sector continues to evolve, with increasing focus on high-tech manufacturing and value-added production.

Embracing the Digital Dawn: Technology and Innovation

Step into Vietnam’s burgeoning tech scene, and you’ll find a landscape bursting with innovation. The country is quickly becoming a regional leader in digital transformation, e-commerce, fintech, and software development. A young, tech-savvy population and government initiatives promoting digital infrastructure are fueling this boom. If you’re asking how to invest in Vietnam in a forward-looking way, the technology sector is a clear answer. Venture capital funds are actively seeking promising startups, and established tech companies are finding fertile ground for expansion. Think beyond traditional industries; the digital frontier here is exhilarating.

Powering the Future: Renewable Energy

Vietnam, with its abundant sunshine and extensive coastline, is perfectly positioned to harness renewable energy. The government’s strong commitment to sustainable development and a push towards greener energy sources has created immense opportunities in solar, wind, and hydropower. Investing in renewable energy isn’t just a smart financial move; it’s an investment in a sustainable future for Vietnam. For those seeking ethical and profitable ventures, this sector represents a vibrant answer to what to invest in Vietnam. The policy framework is becoming increasingly attractive for foreign investors looking to contribute to and benefit from Vietnam’s green revolution.

Navigating Your Investment Journey in Vietnam

Understanding the pathways to investment is crucial. Vietnam has streamlined many processes to welcome foreign capital, but a clear roadmap can make all the difference. Knowing how to invest in Vietnam involves understanding the regulatory environment, identifying the right local partners, and conducting thorough due diligence.

- Research Thoroughly: Dive deep into market trends, legal frameworks, and specific sector performance.

- Seek Local Expertise: Collaborate with local consultants, law firms, or investment advisors who understand the nuances of the Vietnamese market. Their insights are invaluable.

- Understand Regulations: Familiarize yourself with the Foreign Investment Law and other relevant regulations. Patience and preparation are key.

- Identify Strategic Partnerships: Local partners can provide essential market access, operational support, and cultural understanding, especially in emerging markets like Vietnam.

- Start Small, Think Big: Consider starting with smaller investments to gain experience and build confidence before scaling up.

Key Investment Vehicles

There are several avenues for foreign investors to enter the Vietnamese market. Each comes with its own set of advantages and considerations, making it vital to choose the one that aligns best with your investment goals and risk appetite. When considering how to invest in Vietnam, these are some primary options:

| Investment Vehicle | Description | Key Benefit |

|---|---|---|

| Direct Equity Investment | Purchasing shares in publicly listed Vietnamese companies or investing directly into private enterprises. | Direct exposure to specific industries and companies. |

| Foreign Direct Investment (FDI) | Establishing a wholly foreign-owned enterprise, a joint venture, or a Business Cooperation Contract (BCC). | Full control over operations and strategic decisions. |

| Fund Investments | Investing through Vietnam-focused private equity funds, venture capital funds, or exchange-traded funds (ETFs). | Diversification and professional management, often with lower entry barriers. |

| Bond Market | Investing in government bonds or corporate bonds issued by Vietnamese entities. | Potentially stable returns, especially for government-backed instruments. |

Each option requires careful consideration of legal and financial implications. The dynamic nature of Vietnam’s economy means that regulations can evolve, so staying informed is paramount.

Frequently Asked Questions About Investing in Vietnam

What makes Vietnam an attractive investment destination?

Vietnam stands out due to its stable political environment, rapid economic growth, strategic location within ASEAN, competitive labor costs, a large and young workforce, and increasing integration into global trade through various free trade agreements. The government is also proactively implementing policies to attract and facilitate foreign investment.

Are there any restrictions on foreign ownership in Vietnam?

Yes, foreign ownership restrictions exist in certain sectors, although Vietnam has been progressively easing these. Some industries, like banking, logistics, and real estate, may have caps on foreign equity. It’s crucial to consult with legal experts to understand specific industry limitations before proceeding with an investment. The government’s negative list approach clarifies restricted sectors.

What are the common challenges for foreign investors in Vietnam?

While opportunities abound, challenges can include navigating the local regulatory environment, differences in business culture, language barriers, and occasional bureaucratic complexities. Infrastructure, though rapidly improving, can still be a consideration in some remote areas. Partnering with experienced local advisors can help mitigate these challenges.

How can I ensure the safety of my investment in Vietnam?

To safeguard your investment, it is advisable to conduct thorough due diligence, seek legal counsel from reputable firms specializing in Vietnamese law, secure proper licensing and permits, and clearly define contractual agreements. Understanding local customs and building strong relationships with local partners also contributes to long-term success and security.

What is the typical timeframe for seeing returns on investment in Vietnam?

The timeframe for returns varies significantly depending on the sector, the size of the investment, and the specific business model. Real estate and infrastructure projects often have longer gestation periods, while some tech startups might see quicker, albeit higher-risk, returns. A long-term perspective is generally recommended when investing in an emerging market like Vietnam.

Embrace the Future: Your Investment in Vietnam Awaits

The journey of discovering what to invest in Vietnam is one filled with exciting potential. From the vibrant energy of its cities to the fertile grounds of its manufacturing zones and the innovative spirit of its tech hubs, Vietnam offers a unique blend of stability, growth, and opportunity. As a friendly companion guiding you through this incredible land, Vietnam Adventure encourages you to look beyond the immediate and envision the future. The time to explore and engage with Vietnam’s dynamic economy is now. Your next great adventure, and perhaps your next significant investment, could very well be here. Partner with Vietnam Adventure to discover the boundless possibilities that await.